In today’s world, taking ownership of your financial stability and growth is vital, and the first step is to start making informed decisions about where to store and grow your hard-earned money. Two popular options for maximizing interest income are High Yield Savings Accounts (HYS) and Certificates of Deposit (CDs).

A high yield savings account is a savings account that grows your money at a higher rate than traditional savings accounts, while a certificate of deposit is a time deposit that holds your money for a set period of time in exchange for a guaranteed interest rate for the duration of the term.

What is a High Yield Savings Account?

A High Yield Savings Account is a type of savings account offered by financial institutions that provides a higher interest rate compared to traditional savings accounts. The rate at which the savings grow is known as the annual yield percentage (APY). These accounts are typically offered by online banks or credit unions and are designed to help individuals earn more from their savings with a more competitive interest rate. Check out TAB Bank’s High Yield Savings Account as an example.

Pros and Cons of a High Yield Savings Account

Pros:

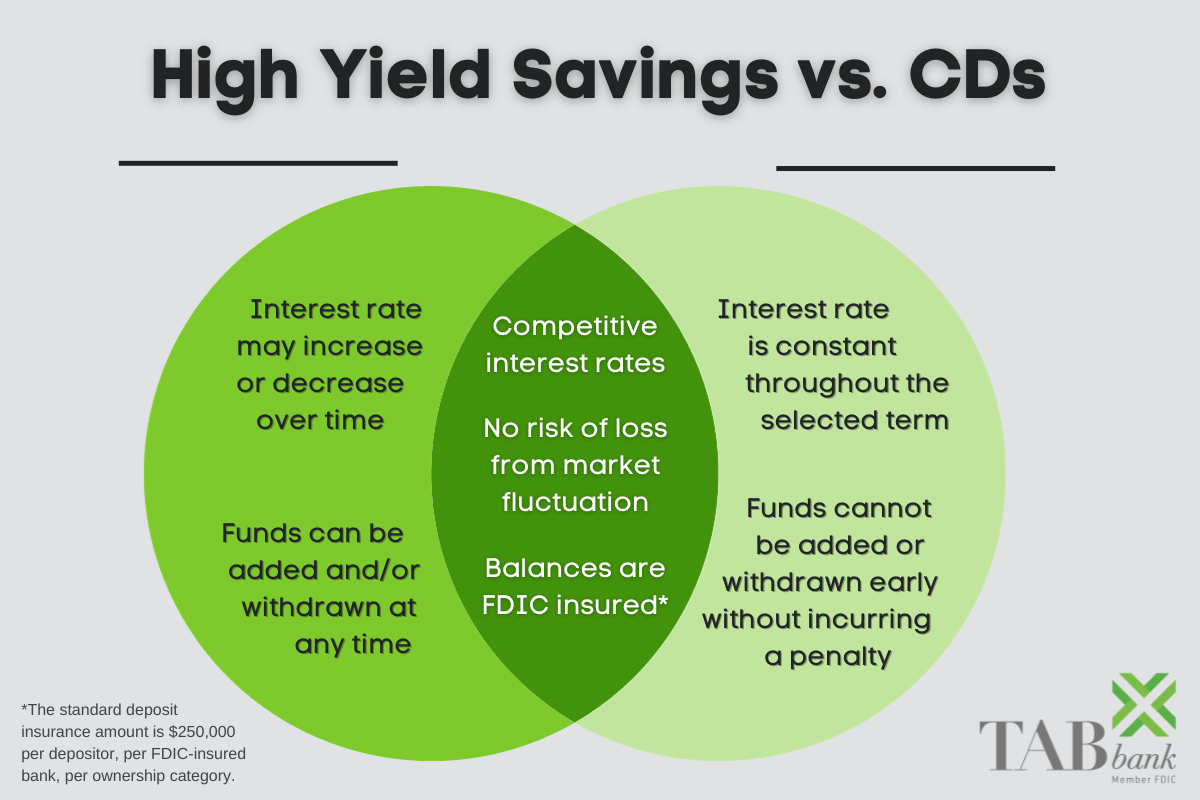

- Higher interest rates: HYS offers higher interest rates compared to traditional savings accounts, allowing your money to grow faster over time.

- Easy access to funds: Unlike longer-term investments, HYS provides quick and easy access to your funds whenever you need them.

- Low minimum opening deposit: HYS often has lower minimum deposit requirements compared to other high-APY banking options, although these requirements vary between banks.

Cons:

- Variable rates: Interest rates on HYS can fluctuate over time, meaning you may earn more or less depending on the current rate market.

- Inflation risk: If the interest rates on HYS fail to keep pace with inflation, the real value of your savings may decrease over time. That said, most high yield savings accounts offer a higher APY than regular savings accounts and so would still help to curb the effects of inflation.

What is a Certificate of Deposit?

A Certificate of Deposit is a time deposit offered by banks and credit unions, where you agree to keep your money locked away for a specific period of time, known as the term. During this term, your money accrues interest at a fixed rate decided when you first deposit the funds. CD rates are typically stated in APY, which makes their value easier to compare with other account options.

Pros and Cons of Certificates of Deposit

Pros:

- Fixed interest rates: CDs offer fixed interest rates for the duration of the term, providing stability and predictability for your earnings.

- Higher interest rates: CDs generally offer higher interest rates compared to traditional savings accounts, although they may be lower than some HYS.

- No market risk: CDs are not subject to market fluctuations during the term of the account, making them a low-risk investment option.

Cons:

- Early withdrawal penalties: Withdrawing funds from a CD before the term expires can result in penalties such as fees or lost interest, potentially eroding your earnings.

- Limited liquidity: Unlike HYS, CDs restrict access to your funds for the duration of the term, which may not be suitable for individuals needing immediate access to their money.

The Difference: CDs vs. High Yield Savings Accounts

The main difference when it comes to CDs vs High Yield Savings accounts is the accessibility of funds deposited and the fluctuation of the APY. A high yield savings account offers more flexible access to funds and can often be opened in tandem with a checking account to make the money even more accessible. However, the APY is subject to change and may fluctuate based on market behavior. CDs are less flexible, and the money is less accessible, but the APY is locked in and will remain steady throughout the term. This can make it a dependable investment tool, though you may earn more or less than with HYS depending on how the marketing fluctuates during the CD term.

When to Choose a Certificate of Deposit

A CD is great if you have long-term savings goals and do not need immediate access to the funds. CDs are useful for long-term savings as the interest rate is fixed and will grow your money at a steady rate.

Another reason to opt for a CD is if you are risk-averse and do not want to bear the mental load of possible rate fluctuations. As discussed, HYS rates may increase or decrease over time, which can make it harder to anticipate your total interest earnings in a given year. If any sort of fluctuation makes you uncomfortable, a CD is an excellent and conservative investment option.

When to Choose a High Yield Savings Account

You should open an HYS if you would like to grow your regular savings at a faster rate but retain easy access to your money. Many use HYS to store their emergency fund because it is secure yet accessible. A high yield savings account is also a great option if you have short-term financial goals such as for a down payment on a house or a vacation fund. The HYS will help grow your savings and offer the short-term flexibility you need.

Using Both

If you are looking to strategically grow your wealth, then using both HYS and CDs can be a great way to diversify your investments.

If you would like to balance liquidity and growth, allocating your savings between HYS and a CD ladder can be a great way to do so. This can be done by putting a portion of your money in the HYS to be used as your everyday savings or emergency fund, and then using CDs for longer-term savings goals.

While both accounts are low risk, opening a HYS along with a CD can be a fantastic way to reap the benefits of both options and diversify your savings further. By allocating a portion of your savings to HYS, you maintain the flexibility to withdraw as needed, and can still enjoy the consistency of a CD APY. Utilizing the two account types together may help to mitigate the risk of incurring CD penalties (should a withdrawal be needed before the end of the term) and avoid the concern of unwanted fluctuations in HYS rates.

Save More with TAB Bank

Choosing the right savings options is crucial for reaching your financial goals. High Yield Savings Accounts and Certificates of Deposit each offer unique advantages and disadvantages, catering to different scenarios. By considering factors such as liquidity, time horizon, and risk tolerance, you can make an informed decision and develop a savings plan that aligns with your objectives. TAB Bank offers competitive APYs on its Certificate of Deposit and High Yield Savings accounts. TAB is FDIC insured (learn more about FDIC insurance for deposit accounts), has excellent customer service, and cares about helping you reach your financial goals. Click below for more information about the benefits of opening a HYS account with TAB Bank.