So you have a PPP loan —

What is next?

This page has been updated for recent changes due to the enactment of the Paycheck Protection Program Flexibility Act of 2020 (PPPFA) on June 5, 2020, and will step through what you need to know to manage your loan and to obtain forgiveness.

Questions about your PPP loan or loan forgiveness? Find the answers below.

The Basics

If you have just obtained a loan from TAB Bank under the Small Business Administration’s (SBA) Paycheck Protection Program (PPP), as amended by the PPPFA, below are some things you need to know.

First, you should know the structure of the loan and what your obligations are. Second, you need to decide if you want the loan forgiven. Finally, if you decide all or a part of the loan cannot be forgiven, you will need to plan to make principal and interest payments to pay off the loan per your loan agreement.

We have created a program that will make it easier for you to file for forgiveness and will walk you carefully through each step. If you have received a PPP loan from TAB Bank, you may access your Forgiveness application here.

The Structure of Your PPP Loan

All PPP loans have the same structure. They are as follows:

- Term: The term of both First Draw and Second Draw PPP loans is two or five years, with the ability to have all or some of the loan forgiven sooner. For PPP loans originated on or before June 4, 2020, the maturity will be two years from the date of funding. If you are not eligible for forgiveness, should you have continued hardship, it may be possible to extend the maturity date to allow for more payment flexibility. For all PPP loans originated after June 4, 2020, the maturity will be five years from the date of funding.

- Payments and Rate: After the Deferral Period, if the loan is not forgiven, you will pay monthly principal and interest according to your note. The interest rate for all loans is set by the SBA at 1.00% per annum and begins accruing the day after funding.

- Deferral Period: All payments on the loan are deferred until the date on which the amount of forgiveness is approved by the SBA, provided that the borrower applies for forgiveness within ten months of the last day of the Covered Period. For borrowers that do not apply within ten months of the end of the Covered period, principal and interest will start to be due immediately.

- Use of Proceeds: Proceeds under PPP loans can be used for payroll costs and benefit expenses plus interest on mortgage loans, rent and utilities as long as these obligations were in force prior to February 15th, 2020.

- Early payoffs: You can pay off your loan at any time, without notice and without penalty.

How You Can Use PPP Funds

While you can use the proceeds of the PPP loan for a wide range of expenses, if you want to obtain forgiveness, you are restricted in what you can use your PPP Loan for. Remember that the loan amount was based on 2.5 times your average monthly payroll from 2019 or 2020. However, you can USE these funds for the following purposes and still get all or a portion of your loan forgiven:

- Payroll: Salary, wage, vacation, parental, family, medical, or sick leave, health benefits

- Mortgage interest: Interest must be from a mortgage that was signed before February 15, 2020.

- Rent: Rent must be from a lease or rental agreement that was in effect before February 15, 2020.

- Utilities: Utilities that are critical for your business, such as electricity, gas, water, waste, telecommunications, and other charges, must be from a service that began prior to February 15, 2020.

How to Get Your Loan Forgiven

The single largest advantage of the PPP program is the ability to have your loan forgiven so you are not obligated to make interest or principal payments.

This will require following the rules of the Program and providing good records proving that you have followed those rules.

- Covered Period: Starting from the day you received the funds of the loan from TAB Bank (not when you electronically signed the agreement), borrowers may elect a Covered Period of eight weeks up to 24 weeks during which to use the PPP funds for payroll and qualified expenses. The advantage of the eight-week period is that it allows borrowers to receive their forgiveness faster, while the 24-week period allows for a longer period for payroll and qualified expense payments to maximize forgiveness eligibility. If the 24-week period is chosen, borrowers must maintain staffing levels for the entire period and (for loans received prior to June 5, 2020) only expenses up to December 31, 2020, can be included.

- 60% to Payroll: At least 60% of your loan proceeds must be used to pay for payroll costs. Payments to independent contractors CANNOT be included in your payroll cost. You can use the remaining 40% of the loan proceeds to pay eligible expenses such as mortgage interest, rent, and utilities.

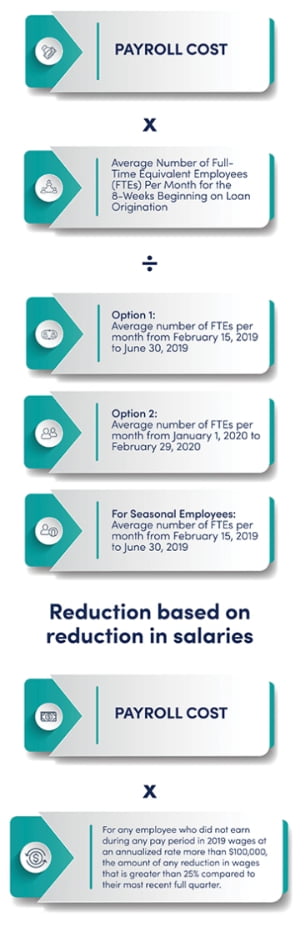

- Headcount: The most important part of forgiveness is to maintain your staffing levels. To understand how much you need to spend on payroll to achieve forgiveness, calculate the average number of full-time equivalent (FTE) employees by using the following calculation: Calculate the average number of employees during the Covered Period (either the eight- or 24-week period) following the date at which you obtained your loan proceeds. Call this “Base Amount”

- Calculate the average number of employees during the Covered Period (either the eight- or 24-week period) following the date at which you obtained your loan proceeds. Call this “Base Amount”

- Calculate the number of FTE employees you had between February 15, 2019, and June 30, 2019. Call this “Option 1.”

- Calculate the number of FTE employees you had between January 1, 2020, and February 29, 2020. Call this “Option 2.”

- Base Amount: Take the Base Amount and divide by Option 1 then do the same by dividing by Option 2. Take the largest number between your Option 1 and Option 2 calculation. Also note that if you are a seasonal employer, you must use Option 1. Note that borrowers can adjust option for FTE safe harbor exemptions (see below).

- If the result of your calculation is larger than “1,” then you successfully maintained your headcount, and you meet this requirement in full.

- If you get a number smaller than “1,” then you did not maintain your original headcount and the amount for which the PPP loan can be forgiven will be reduced proportionately. For example, if your calculation resulted in a “0.75” result, then you could be eligible for getting up to 75% of your loan forgiven provided you meet the other criteria.

- Salary/Wage Amount: For every employee that did not make more than $100,000 of annualized pay for 2019, you must maintain 75% of the pay received during the eight-week test period compared to the most recent quarter they were employed. If pay was reduced below 75% compared to the quarter prior to the eight-week test period, then forgiveness will be reduced by that difference. For example, if you reduced pay by 50%, then 75% – 50% equals a reduction of forgiveness by 25%.

- Rehiring: If you furloughed, laid off, or terminated staff prior to the eight-week test period, you can hire them back prior to June 30th, 2020 to still qualify for all or a portion of forgiveness. Further, if you reduced salary below the 75% level, you can also reinstate any pay below that level. If the employee rejects your reinstatement offer, borrowers may be allowed to exclude this employee when calculating forgiveness. To qualify for this exemption, you must:

- Make a written offer to rehire in good faith;

- Have offered to rehire for the same salary/wage and the number of hours as before they were furloughed or laid off; and,

- Receive a rejection by the former employee in writing.

- Other “Safe Harbor” Employee Exemptions: In addition to the above, borrowers can also qualify for an exemption for the sake of payroll calculation if an employee was fired for cause, voluntarily resigned or voluntarily requested a reduction in his or her hours. Borrowers may also be required to demonstrate that they were unable to hire similarly qualified employees for unfilled positions, or document that due to safety requirements, borrowers were unable to return to normal operating levels. It should also be noted that any employee who rejects an offer for re-employment may no longer be eligible for continued unemployment benefits.

Simplified Forgiveness Form Options

On June 16, 2020, the SBA issued a simplified PPP Loan Forgiveness Application called the 3508EZ Form. This “EZ Form” is designed to reduce the required calculations for those that qualify. To qualify, borrowers must:

- be self-employed AND have no other employees; OR

- NOT have reduced salaries or wages of their employees by more than 25%, and must not have reduced the number of hours of their employees; OR

- have suffered a reduction of business activity as a result of health directives related to the COVID-19 pandemic and did not reduce salaries or wages of employees by more than 25%.

If you, a borrower, do not qualify under one of the three criteria, you must use the standard Forgiveness form called the “3508 Form”

Beginning October 8, 2020, the SBA further simplified the loan forgiveness process for recipients of PPP loans of $150,000 or less by issuing the Form 3508S. This one-page form requires fewer calculations and less documentation for eligible borrowers.

On August 4, 2021, the SBA opened a PPP Direct Forgiveness Portal for borrowers with loan amounts of $150,000 to seek forgiveness. Qualifying borrowers can create an account and submit their forgiveness application at https://directforgiveness.sba.gov/.

The Forgiveness Application

The SBA forgiveness forms linked above are available for reference and to help borrowers better understand the process and requirements. However, borrowers should NOT mail, email, or fax the completed forms to their banker. TAB Bank has partnered with SmartBiz to provide a guided and expedited forgiveness process that is available online. PPP borrowers will input the required information, complete the certifications, and e-sign the completed application using the online portal. To begin or submit your PPP loan forgiveness application, log in here with your SmartBiz account credentials.

The Documents You Will Need for Forgiveness

Borrowers who do not qualify for the simplified Form 3508S process will need to upload documents verifying the number of full-time equivalent employees on payroll and their pay rates, for the periods used to verify you met the staffing and pay requirements. These documents can be one or more of the following:

- Payroll reports from your payroll provider.

- 2019 Payroll tax filings (Form 941)

- Bank account statements showing qualified payroll, mortgage/lease payments or utility expenses.

- Schedule of employees to include their name, employee number, and compensation.

- Income, payroll, and unemployment insurance filings from your state.

- Documents verifying any retirement and health insurance contributions.

- Documents verifying your eligible interest, rent, and utility payments (canceled checks, payment receipts, account statements) if these are being claimed.

- Documents evidencing any FTE safe harbor exemptions – written evidence that previous positions were offered and declined, were fired for cause, voluntarily resigned, or voluntarily requested a reduction in hours.

- In all cases, the borrower only has to potentially show written evidence if the position was not filled by another employee and forgiveness is being sought.

- If applicable, EIDL Advance amount and application number.

Note – If these documents are not in digital form, please take the time soon to scan these and get them ready for upload using an Adobe PDF, JPEG or PNG file format. Please note that you can take a high-quality picture of the document and then upload the photo.

Documents That Borrower Must Maintain But Are Not Required to Upload

Borrowers who do not qualify for the simplified Form 3508S process will need to upload documents verifying the number of full-time equivalent employees on payroll and their pay rates, for the periods used to verify you met the staffing and pay requirements. These documents can be one or more of the following:

The following documents should be kept for six years after the loan is forgiven or repaid in the event the Office of the Inspector General, Bank, SBA, IRS or other entity needs to review

- Compensation: Documentation (payroll records, staffing schedules, etc.) supporting the certification that annual salaries or hourly wages were not reduced by more than 25 percent during the Covered Period or the Alternative Payroll Covered Period relative to the period between January 1, 2020 and March 31, 2020.

- FTE and Hours: If applicable, documentation supporting that the Borrower did not reduce the number of employees or the average paid hours of employees between January 1, 2020 and the end of the Covered Period (other than any reductions that arose from an inability to rehire individuals who were employees on February 15, 2020, if the Borrower was unable to hire similarly qualified employees for unfilled positions on or before December 31, 2020). This documentation must include payroll records that separately list each employee and show the amounts paid to each employee between January 1, 2020 and the end of the Covered Period

- Safe Harbor Employees: Documentation regarding any job offers and refusals, refusals to accept restoration of reductions in hours, firings for cause, voluntary resignations, written requests by any employee for reductions in work schedule, and any inability to hire similarly qualified employees for unfilled positions on or before December 31, 2020.

- Operations: If applicable, documentation supporting that the Borrower was unable to operate between February 15, 2020 and the end of the Covered Period at the same level of business activity as before February 15, 2020 due to compliance with requirements established or guidance issued between March 1, 2020 and December 31, 2020 by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration, related to the maintenance of standards of sanitation, social distancing, or any other work or customer safety requirement related to COVID-19. This documentation must include copies of the applicable requirements for each borrower location and relevant borrower financial records.

- Other Supporting Materials: Borrowers should retain all worksheets, calculations, schedule or other records relating to the Borrower’s PPP loan, including documentation submitted with its PPP loan application, documentation supporting the Borrower’s certifications as to the necessity of the loan request and its eligibility for a PPP loan, documentation necessary to support the Borrower’s loan forgiveness application, and documentation demonstrating the Borrower’s material compliance with PPP requirements.

Loan Forgiveness Details and Limits

- Self-Employed: Borrowers that are self-employed are entitled to use PPP funds to replace lost compensation due to the impacts of COVID-19. It is important to note, however, that borrowers are not entitled to use the full amount of the loan to replace pay. Only eight-weeks’ worth of a borrower’s 2019 net profit is eligible for forgiveness. Borrowers with mortgage interest, rent, or utilities expenses must have claimed (or be entitled to claim) these expenses as a deduction on their 2019 Form 1040 Schedule C in order for these expenses to be eligible for forgiveness.

- Partnerships: Borrowers that are general partners in a partnership are eligible to claim the same level of compensation as they were making as partner compensation when they applied for the PPP. Partner compensation is capped at the 2019 Schedule K-1 net earnings from self-employment (reduced by claimed section 179 expense deduction, unreimbursed partnership expenses, and depletion from oil and gas properties), all multiplied by 0.9235.

- Non-Payroll Expenses: All eligible non-payroll expenses must be paid during the Covered Period (not the Alternative Payroll Covered Period) OR incurred and paid on or before the next regular billing date, even if the billing date is after the Covered Period.

- $100,000 Limit: Be aware that if you pay any single employee (including yourself) more than $3,846.15 per 2-week pay period (an annualized $100,000 per year) that amount will not count towards the loan forgiveness. At time of this posting, the SBA has been vague about the exact way ineligible pay is deducted from the forgiveness amount, so, for best results, be conservative.

EIDL Grant Recipients

If you received a grant up to $10,000 from the Economic Injury Disaster Loan (EIDL) program, those proceeds will no longer be deducted from your PPP forgiveness amount.

Forgiveness for Second Draw PPP Loans

The PPP forgiveness application process and forms are the same for both First Draw and Second Draw PPP loans. Recipients of a Second Draw PPP loan should be prepared to upload documentation showing a 25% (or more) decrease in revenue for any quarter of 2020 compared to the same quarter of 2019, or a full-year revenue decrease of 25% or more.

If Your Loan is NOT Forgiven

Your loan may not be approved for forgiveness or you may decide not to ask for forgiveness because you do not meet the forgiveness requirements. In this case, you will begin to make your principal and interest payments after the Deferral Period until the loan is extinguished.

Ineligible Borrowers

The SBA has stated they will be reviewing ALL loans above $2 million and will sample the rest. Thus, it is highly recommended if you do NOT meet the PPP requirements that you contact TAB Bank to pay off your loan immediately. While not an exhaustive list, borrowers that meet any of the following criteria are those that may not qualify for PPP loans and should consult with their legal and financial professionals to consider repaying their PPP loan. For further information, consult 13 CFR 120.110.

- Borrowers that knowingly provided false information during their application process

- Financial businesses primarily engaged in lending or life insurance (e.g., banks and credit unions)

- Businesses headquartered outside of the U.S. or owned by undocumented aliens

- Businesses involved in any illegal activity

- Businesses involved with pyramid sales distribution plans

- Businesses that derive more than one-third of their gross annual revenue from legal gambling

- Private clubs and businesses which limit the number of members for reasons other than capacity

- Businesses with an associate who is incarcerated, on probation, parole or who have been indicted for a felony or crime of moral turpitude

Frequently Asked Questions

FAQs are subject to change as more guidance becomes available.