-

Non-Recourse Factoring: Is It Right For Your Business?

For small business owners, managing cash flow effectively is a critical aspect of financial health. One financial tool that can help maintain liquidity and manage receivables is factoring. Factoring is a financial service that can transform your business dynamics and increase capital on hand. If you have been considering factoring, you’ve probably seen the terms…

-

How Much Money Should I Keep in My Checking Account?

A checking account is often one of the first financial accounts people open, and for good reason. It enables you to securely store your money, easily pay for everyday expenses, and more. Still, as your finances evolve, so should the way you manage those finances. A checking account is incredibly helpful and convenient, but not…

-

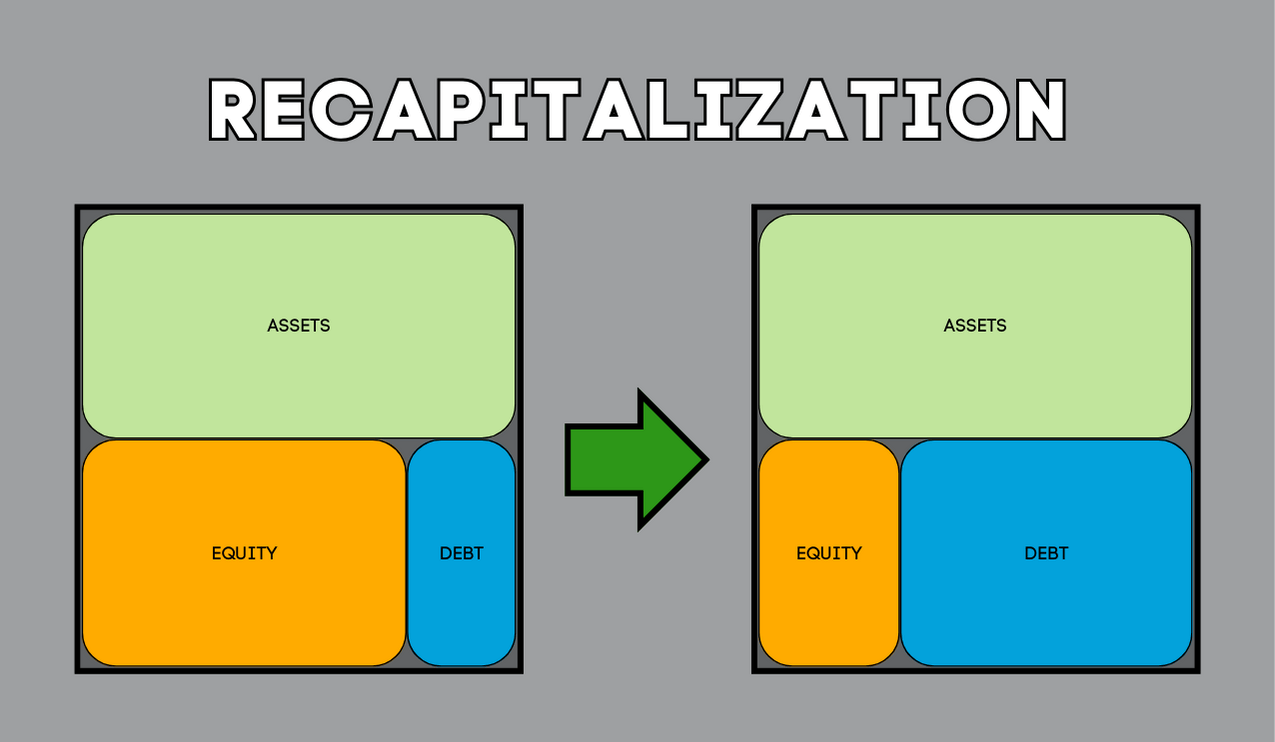

What is Recapitalization?

Recapitalization is when companies shift their debt-to-equity ratio. Reasons behind the shift vary depending on company size, performance, and goals.

-

Accounts Receivable Financing vs Factoring

Financing is using invoices as collateral, factoring involves the purchase of your invoices. Learn more with TAB Bank.

-

High Yield Savings Account vs. Money Market Account

Choosing between a high-yield savings account and a money market account can be difficult. Learn the differences between them and which will work better for you.

-

High Yield Savings Account vs Roth IRA

A high-yield savings account and Roth IRA both help you save money for your future, but each account has a unique purpose.

-

What is Working Capital Financing?

Working capital financing can help a business with low liquidity make payments on its day-to-day expenses and maintain operations.

-

What is Working Capital Management? Definition, Elements, & Ratios

Working capital management is the process of forecasting current assets and liabilities to ensure working capital needs are met.

-

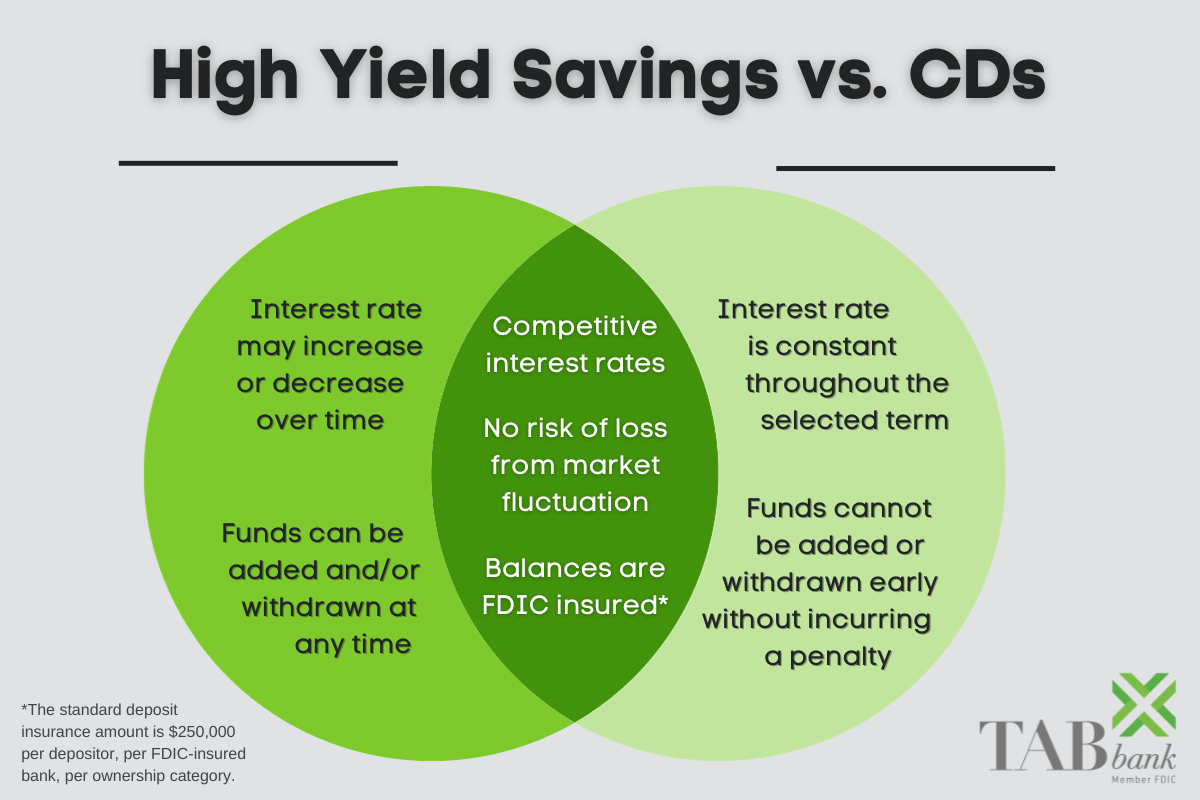

CDs vs High Yield Savings Account: Which is Better?

CDs offer locked-in APYs but little liquidity, while High Yield Saving APYs fluctuate but your funds remain easy to access. Learn more with TAB Bank.

-

What is Open Banking & How Does It Work?

in BlogJust learned of Open Banking? Let’s talk about it, learn what it is, and how it can affect you and your banking habits.

Search the website

Popular Categories

- Accounts Receivable Financing (13)

- Asset-based Lending (12)

- Blog (130)

- C-Suite (4)

- Employment/Career (4)

- Entrepreneur (1)

- Factoring (10)

- Financing (19)

- Financing Options (23)

- Fleet Management (11)

- Fuel Prices (2)

- General Business Tips (32)

- General Trucking News (7)

- Leadership (2)

- Legacy, Blog Source (6)

- Legacy, Home (15)

- Legacy, Press Releases Source (2)

- Marketing (2)

- Paycheck Protection Program (PPP) (3)

- Payments (2)

- Personal Banking Tips (20)

- Press Releases (140)

- Raising Capital (14)

- Safety (4)

- Sales (3)

- TAB Bank in the News (11)

- Trucking (20)

- Trucking Equipment (10)

- Uncategorized (12)