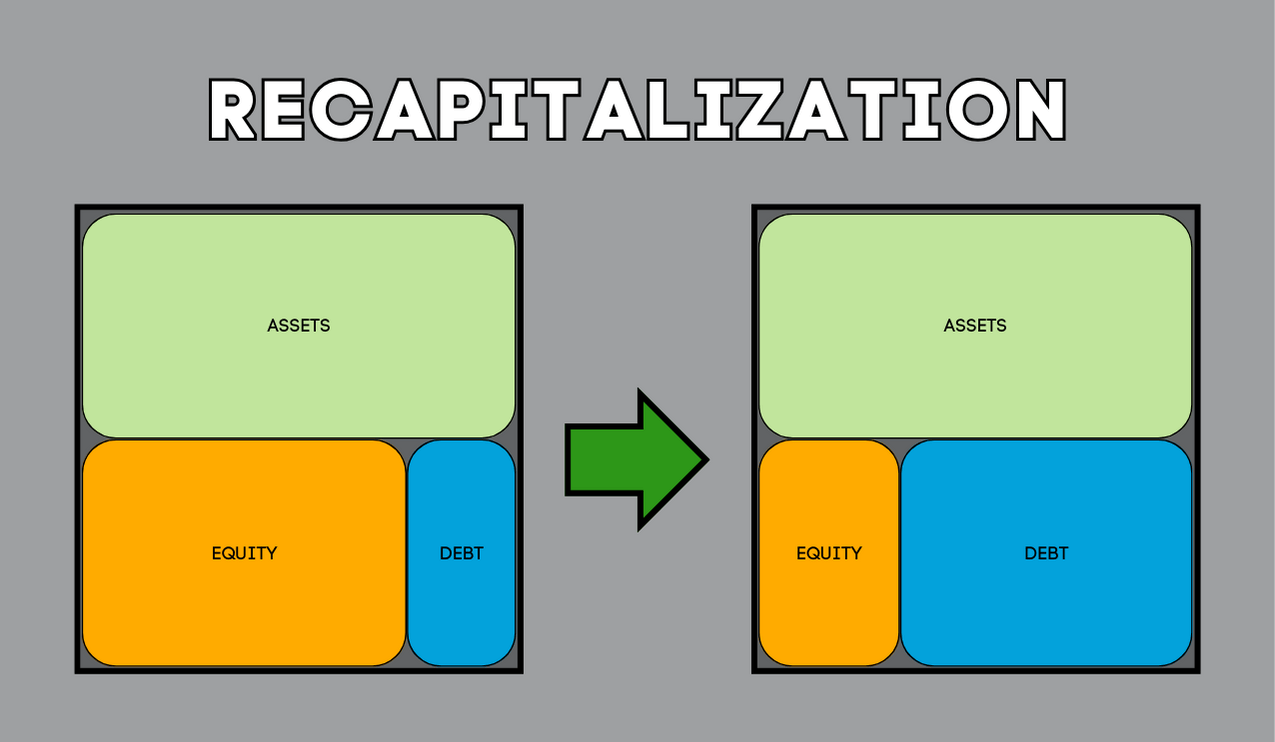

Recapitalization is a financial process where a company restructures its debt-to-equity ratio to stabilize or improve its capital structure. This restructuring can involve exchanging one form of financing for another—like replacing equity with debt, or the other way around.

Recapitalization provides companies with a flexible approach to finance management by allowing them to adjust their capital structures to both internal needs and external market conditions.

What is capital structure?

Capital structure is how a company uses its mix of debt and equity to fund operations and growth. Recapitalization is how a company shifts its debt and equity to create a balance that better meets its needs.

Types of Recapitalization

There are multiple ways recapitalization can occur. The route a company will take depends on the reason they are restructuring and the resources and entities influencing the process.

Leveraged Recapitalization

Leveraged recapitalization involves a company taking on significant amounts of debt to buy back its own shares or pay dividends to shareholders. This strategy increases the company’s debt load but can also increase shareholder value in the short term and create a tax shield from the interest payments on the new debt.

Equity Recapitalization

Equity recapitalization involves a company issuing new shares of stock to increase equity capital, often diluting the existing shareholders’ value. This can be a strategy to pay down debt and reduce leverage, improving the company’s financial health and stability.

Leveraged Buyout

A leveraged buyout is a form of recapitalization where a company is purchased using a large amount of borrowed money. The assets of the company being acquired and those of the acquiring company are often used as collateral for the loans.

Reasons Companies Recapitalize

Companies choose to recapitalize for a variety of reasons, each determined by their unique financial circumstances and strategic goals. However, it’s important to keep in mind that not all reasons for recapitalization are relevant to every company.

Improve Liquidity

By diversifying their debt-to-equity ratio, companies can improve liquidity, ensuring they have enough cash on hand for day-to-day operations and growth opportunities.

Small to medium-sized businesses (SMBs) often use this form of recapitalization. These companies may need to ensure sufficient working capital for operations, but due to their size, may not have access to capital markets as easily as larger businesses.

Reduce Financial Obligations

Companies may recapitalize to alter their debt obligations, either by extending the maturity of their debt, reducing the interest rate, or converting debt to equity to ease financial pressure.

Small to medium-sized enterprises (SMEs) up to large corporations can benefit from this strategy. Companies with substantial debt looking to improve their balance sheets and reduce interest payments might consider this option to better manage financial obligations.

Reorganize During Bankruptcy

During bankruptcy, recapitalization can be a tool for reorganization, allowing a company to come out healthier by restructuring its debt and equity to achieve a more sustainable capital structure.

This can apply to companies of all sizes, from small businesses to large corporations. The key factor is the company’s financial distress level and the need to restructure its debt and equity to navigate through bankruptcy proceedings effectively.

Prevent a Hostile Takeover

Recapitalization can be a defensive strategy against hostile takeovers, either to make the company less attractive to the potential acquirer or dilute the value of shares to make a takeover more expensive and less appealing.

Medium to large companies, especially those with publicly traded shares, might employ recapitalization as a defense mechanism. These companies are more visible and potentially attractive targets for takeovers.

A Large Drop in Stock Price

A substantial drop in stock price can motivate a company to recapitalize to stabilize its market value, making it more attractive to investors and potentially preventing further decline.

This reason for recapitalization is typically reserved for publicly traded companies because they have publicly traded shares and are more susceptible to market fluctuations that can significantly impact their stock price.

Take Advantage of Upcoming Opportunities

Recapitalization allows businesses to adjust their capital structure for improved stability or to pursue growth opportunities without fully relinquishing control.

This strategy can be relevant for companies across the spectrum, from startups and SMEs to large corporations. The focus of this strategy is on agility and the ability to quickly capitalize on growth opportunities, which is important for companies at all stages of development. Because the recapitalization process can be timely, proactively identifying growth opportunities is necessary to adjust and pursue them.

What is the Recapitalization Process?

Recapitalization is a substantial process that begins with a thorough planning phase. Companies must maintain accurate and comprehensive financial records, assess their goals, and consult with advisors experienced in recapitalization.

The Recapitalization Process for Small to Medium-Sized Businesses

For small businesses, the recapitalization process often involves negotiating with current investors and lenders to restructure the company’s financial obligations, possibly seeking new investors or financing options to better align the capital structure with the company’s operational needs and growth objectives.

The process can span several months, during which the company’s leadership must navigate complex negotiations, financial analyses, and strategic planning sessions to ensure the chosen recapitalization path aligns with long-term goals.

Choosing the right partner when undergoing recapitalization is a key element to success, especially if you are an SME new to this process.

Recapitalizing with TAB Bank

If you are looking to recapitalize you will likely need additional capital or a new lender altogether. At TAB Bank, we offer a wide range of funding options perfect for small to medium-sized businesses looking to restructure their balance sheet and seize growth opportunities.

From asset-based lending to more traditional small business loans and lines of credit, TAB Bank is dedicated to finding you the right funding so your business can succeed in its recapitalization process. Explore TAB’s tailored lending solutions today!