-

Top 8 Truck Stops in the US

in TruckingMost truck stops you come across will probably be pretty similar to each other. Some truck stops you’ll avoid at all costs. But here are some of the most highly rated truck stops in the country to look out for next time you’re on the road. These stops not only provide essential services but also…

-

How to Save Money on Fuel for Your Trucking Company

in TruckingFuel costs are the number one expense for trucking companies. Fuel is an essential component for the operation of trucks, but there are several strategies you can employ to reduce your fuel expenses significantly. Here are a few practical tips that can help you save big on your fuel costs. Use Cruise Control Constantly accelerating…

-

Pets for Truckers: Adorable Co-Pilot or Absolute Chaos?

in TruckingAround 40% of all truck drivers have a pet that travels with them on the road. If you are considering adding a furry friend to your truck cab, here are a few pros and cons to consider. Pros: Alleviate Loneliness and Improve Health Pets, both inside and outside the trucking world, have been proven to…

-

How to Eat Healthy as a Trucker

in TruckingAs a trucker, you face a unique set of challenges, and maintaining a healthy diet on the road is one of the biggest. Here are some tips and tricks to help you eat healthier and feel better while traveling. Pack Your Own Food It’s easy to grab meals from restaurants or truck stops when you’re…

-

Non-Recourse Factoring: Is It Right For Your Business?

For small business owners, managing cash flow effectively is a critical aspect of financial health. One financial tool that can help maintain liquidity and manage receivables is factoring. Factoring is a financial service that can transform your business dynamics and increase capital on hand. If you have been considering factoring, you’ve probably seen the terms…

-

How Much Money Should I Keep in My Checking Account?

A checking account is often one of the first financial accounts people open, and for good reason. It enables you to securely store your money, easily pay for everyday expenses, and more. Still, as your finances evolve, so should the way you manage those finances. A checking account is incredibly helpful and convenient, but not…

-

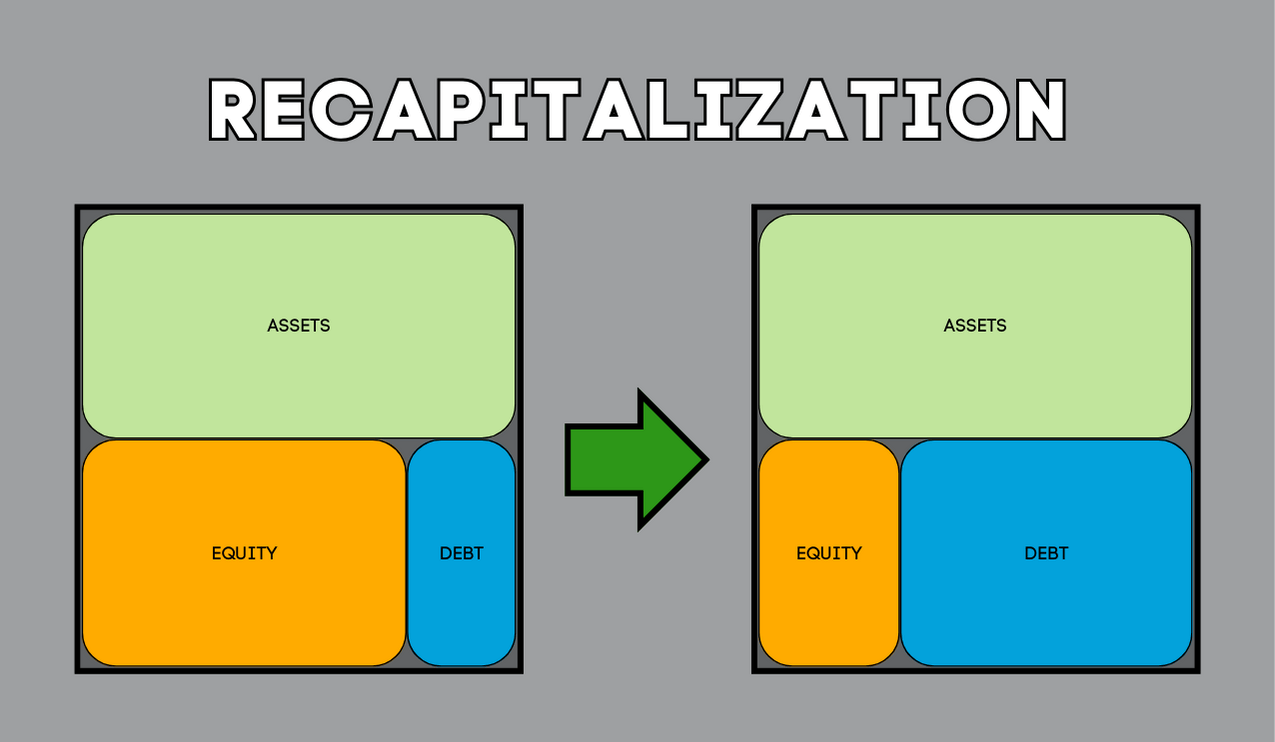

What is Recapitalization?

Recapitalization is when companies shift their debt-to-equity ratio. Reasons behind the shift vary depending on company size, performance, and goals.

-

Accounts Receivable Financing vs Factoring

Financing is using invoices as collateral, factoring involves the purchase of your invoices. Learn more with TAB Bank.

-

High Yield Savings Account vs. Money Market Account

Choosing between a high-yield savings account and a money market account can be difficult. Learn the differences between them and which will work better for you.

Search the website

Popular Categories

- Accounts Receivable Financing (13)

- Asset-based Lending (12)

- Blog (130)

- C-Suite (4)

- Employment/Career (4)

- Entrepreneur (1)

- Factoring (10)

- Financing (19)

- Financing Options (23)

- Fleet Management (11)

- Fuel Prices (2)

- General Business Tips (32)

- General Trucking News (7)

- Leadership (2)

- Legacy, Blog Source (6)

- Legacy, Home (15)

- Legacy, Press Releases Source (2)

- Marketing (2)

- Paycheck Protection Program (PPP) (3)

- Payments (2)

- Personal Banking Tips (20)

- Press Releases (140)

- Raising Capital (14)

- Safety (4)

- Sales (3)

- TAB Bank in the News (11)

- Trucking (20)

- Trucking Equipment (10)

- Uncategorized (12)